- No. 7 Disa Road, Extension 8, Kempton Park

- pension@mepf.co.za

- +27 11 578 5333

By MEPF

MEPF Newsletter 2nd edition

Dear Member,

In this issue, we continue to provide key insights about your fund, address recent misinformation campaigns, and update you on the 2025 Benefit Statements. We also delve into the impact of divorce claims on your pension fund benefits, helping you understand how such claims can affect your retirement savings and why using your pension as a ‘cash-in’ option can have lasting consequences.

And we highlight the importance of keeping your beneficiary nominations current, accessing your fund information online through the MEPF Member Portal and mobile app, our upcoming member education sessions, and planning for every stage of your financial journey. There are dedicated financial advisors available to help you with personalized retirement planning- ensuring you make the most informed decisions for your future. Your financial future is our top priority—read on to stay informed and empowered

Understanding the Impact of Divorce Claims on Your Pension Fund Benefits

Divorce can have significant financial implications, especially when it comes to pension fund benefits. It’s important for members to understand how a divorce claim can affect their retirement savings, whether they belong to a Defined Benefit (DB) or Defined Contributions (DC) fund.

How Divorce Claims Affect Pension Fund Members

- Legal Framework: In terms of the Divorce Act and the Pension Funds Act, a pension fund may be required to pay a portion of a member’s pension interest to an ex-spouse (the nonmember spouse) as part of a divorce settlement.

Defined Benefit Funds: Impact on Members

- Reduction in Benefit Amount: When a divorce claim is processed and a portion of the member’s pension is paid to the ex-spouse, the member’s total pensionable amount is reduced.

- Reduction in Years of Service: The years of pensionable service will be reduced proportionally to the amount paid out.This means that not only does the member’s benefit decrease, but their credited service period (which is used to calculate the pension) is also shortened.

- Long-Term Impact: This can have a significant effect on the member’s final pension at retirement, as both the value and the years used in the calculation are lower.

Defined Contributions Funds: Impact on Members

- Reduction in Fund Value: In a DC fund, the divorce claim results in a direct reduction of the member’s accumulated fund value. The amount paid to the ex-spouse is deducted from the member’s savings, which means there is less capital available to grow for retirement.

Important Considerations for Members

- Long-Term Consequences: Members should be aware that a divorce claim reduces their retirement benefit, either by lowering the fund value or the years of service credited. This can significantly affect retirement planning and income.

- Not a Cash-In Option: It is important to note that using a divorce claim as a means to “cash in” on a pension is not advisable, as it can have lasting negative effects on retirement security.

- Seek Advice: Members facing divorce should consult with financial advisors or the fund’s representatives to fully understand the implications and plan accordingly.

Divorce claims can have a lasting impact on your pension benefits. Whether you are in a Defined Benefit or Defined Contributions fund, it’s crucial to understand how your retirement savings may be affected and to make informed decisions to protect your financial future.

Everything you need to know when planning on retiring.

Defined Benefit member planning to go on Retirement

Members with ten years of service with the Fund will receive the following benefits:

- Gratuity and a Monthly Pension for life.

Members with less than ten years of service with the Fund will receive the following benefits:

- Once-off payment which is the higher of the minimum Individual Reserves or Net withdrawal benefit.

Defined contribution Members planning to go on retirement.

- The member will receive one-third of their Fund credit from the Fund as a lump sum payment and they will need to purchase an annuity with the remaining balance.

- Members are advised to contact their Financial advisors to assist with the Purchase of Annuities as part of retirement councilling.

Plan for Retirement- Start Today with Expert Guidance

Retirement is not a single event- it is a journey that begins with daily decisions and long-term planning. At MEPF, we remind members that early retirement can start from age 55 up to 64, while normal retirement is from 65 up to 70. Planning for your retirement at every life stage is crucial for your financial security.

To help you prepare, there are financial advisors ready to walk with you through your pre-retirement journey. They will help you develop personalised solutions, construct an investment portfolio based on your chosen strategy, and manage it on a discretionary basis.

Consulting with a financial advisor ensures that, should you retire, become disabled, or pass away, your financial needs and those of your beneficiaries are taken care of. It is never too early to start planning- secure your future by engaging with a financial advisor today.

For personalized financial planning and retirement advice, contact Clive Ramathibela Smith, who will guide you through your pre-retirement journey: 083 890 0443.

Setting the Record Straight: MEPF vs Misinformation

We continue to caution members, HR officials, Municipal Managers, and all stakeholders against the deliberate misinformation campaign led by Ndou Attorneys. These claims have caused confusion and unnecessary panic.

In a recent eNCA interview on 11 May 2025, our very own Marketing Manager, Mathawe Matsapola, addressed and dismantled the false allegations made by Phumudzo Ndou. The interview highlighted the stability, compliance, and integrity of the MEPF, reaffirming our commitment to transparency and accountability.

We urge all members to seek information directly from the Fund or designated HR channels and not from unverified sources.

Your 2025 Benefit Statement is Coming Soon

Every year, the Fund undergoes an independent financial audit to assess its financial health. This audit is a regulatory requirement and ensures that your pension benefits remain secure and accurately managed.

Our financial year ends on 28 February, and we have up to 6 months to complete the audit process. Once finalized, your 2025 Benefit Statements will be issued and will also be available on the portal. We appreciate your patience and understanding as we finalize this important work.

Keep Your Beneficiaries Up to Date

Life changes—and so should your records. Whether you’ve gotten married, divorced, had a child, or experienced any other life change, it’s important to update your Death Nomination Form and Funeral Forms. Keeping your information current is essential to ensure that we are able to process any future claims efficiently and without unnecessary delays or disappointment.

Please visit your HR Office for forms or visit our website at mepf.co.za to download the forms to make updates. Kindly email any changes to pension@akafin.co.za. Don’t leave this critical detail unattended.

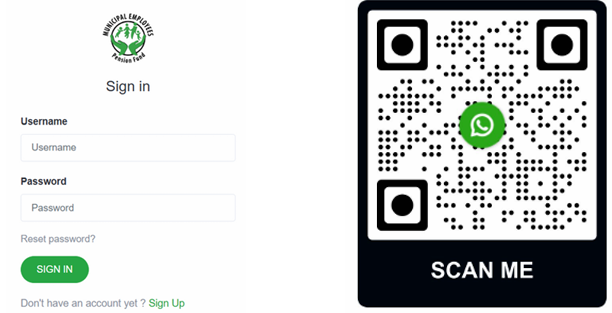

Access the MEPF Member Portal and Stay Connected

We encourage all members to make use of the MEPF Member Portal for easy access to your fund information. Visit the MEPF website, click on the Member Login tab, and register to create your unique credentials. Once registered, you can log in to view your fund information.

For added convenience, you can also download the MEPF Portal App from the Google Play Store, allowing you to access your account directly from your mobile device. Stay informed by following the MEPF WhatsApp Channel for real time updates and important announcements. We encourage all members to utilize these platforms to stay updated with your fund information.

Member Portal Whatsapp Channel

We’re Coming to You! Member Education Sessions in Your Municipality

In our ongoing mission to enhance communication and reduce member frustrations, our Stakeholder Relations Officers will be visiting municipalities across the country.

These Member Education Sessions are vital—they provide updates, answer questions, and educate you about how the fund works and how to maximize your benefits.

📢Watch for announcements from your HR office and make every effort to attend. Knowledge is your greatest retirement asset!

In Closing

To every MEPF member: thank you for your trust, loyalty, and continued support. We are honoured to serve you and remain steadfast in our promise to protect your financial future and safeguard the well-being of your loved ones.

Together, we are building not just a pension fund, but a legacy of dignity and security. Our Stakeholder Relations Officers are always ready to assist you.

Contact Numbers:

1.Lebo Molemane: 066 020 8535 (North West, Mpumalanga)

2.Siphesihle Ntombela 072 352 4792 (Eastern Cape)

3.Tsamai Ratsela 082 289 0100 ( Free State, Gauteng)

4.Gudani Mufhadi 072 352 7144 ( Free State, Limpopo, Mpumalanga, North West)

5.Thulani Mthombeni 082 585 5931 (Gauteng, KZN, Northern Cape)

6.Wisani Shiviti 072 352 6894 (Limpopo, Mpumalanga)

Regards,

Municipal Employees Pension Fund (MEPF)

Your Number 1 Pension Fund

Similar News.

Similar News.

SUBSCRIBE to our NEWSLETTER below.

The Fund is administered by Akani Retirement Fund Administrators (Pty) Ltd.

© Copyright